The FT Group includes many of the world's most respected business information brands. Through the leading global business newspaper and online service, the pre-eminent national titles in many countries and a trusted provider of financial data and analysis, we reach a worldwide audience of 10 million people every day. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

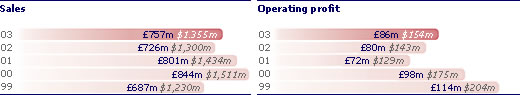

The Financial Times Group increased profits by 8% despite a 3% revenue decline as Interactive Data (IDC), our asset pricing business, posted an 18% profit increase. For our business newspapers, 2003 was the third year of a savage corporate advertising recession which has seen advertising volumes at the Financial Times fall almost two-thirds since their peak in 2000. Over the same period, we have reduced the FT's cost base by more than £100m. Losses at the Financial Times were £9m higher than in 2002 as advertising revenues fell by £23m and we invested some £10m in the newspaper's continued expansion around the world. Advertising revenues were down 15% as industry conditions remained tough for the FT's key advertising categories of corporate finance, technology and business-to-business. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Olivier Fleurot, Chief executive officer, The Financial Times Group |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The advertising declines were significantly worse immediately before and during the war in Iraq, but the rate of decline began to narrow towards the end of the year, helped by growth in US, online and recruitment advertising. The newspaper's circulation in the six months to January 2004 was 433,000, 4% lower than in the same period last year, although FT.com's subscribers are some 50% higher at 74,000. The launch of our Asia edition in September completed the FT's global network of four regional newspaper editions, backed up by a single editorial, commercial and technology infrastructure and by FT.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profits at Les Echos were behind last year, reflecting continuing declines in advertising revenues and investment in the newspaper's relaunch. Average circulation for the year was down 4% to 116,400, but the September relaunch generated a positive response, with newsstand sales in the final quarter up 4% against a market decline of 6%. Despite a continued decline in the advertising market, FT Business posted profit growth, due to tight cost management. The FT's associates and joint ventures returned to profit (£6m loss in 2002) with good progress at FT Deutschland, our joint venture with Gruner + Jahr, and at the Economist Group, in which Pearson owns a 50% interest. FT Deutschland's average circulation for 2003 was 92,000, an increase of 9% on the previous year and advertising revenues increased in a declining market. The Economist Group increased its operating profit despite further revenue declines, reflecting additional measures to reduce costs. The Economist's circulation growth continued, with average weekly circulation 3% higher at 908,000. Revenues at Recoletos (Bolsa Madrid: REC), our 79%-owned Spanish media group, were up 4% as its consumer titles including sports newspaper Marca performed strongly, more than offsetting further advertising revenue decline at business newspaper Expansión. Profits were 11% lower as Recoletos invested in existing and new titles. Average circulation at Marca increased 3% to 391,000, and at Expansión fell 3% to 46,000. Interactive Data Corporation (NYSE: IDC), our 61%-owned asset pricing business, grew its underlying revenues in a declining market for the fourth consecutive year. Revenues increased by 2% and profits by 18%, despite continuing weakness in the market for financial services as institutions focused on containing costs. It was helped by strong institutional renewal rates, which continue to run at more than 95%, the addition of new asset classes to its core pricing services, and the successful launch of our Fair Value Pricing service, which is now installed in 35 leading institutions. IDC continued to extend its range of services through new products such as e-Finance Solutions, enhancements of existing products such as BondEdge and eSignal and bolt-on acquisitions including Comstock, a real-time financial data service, and Hyperfeed Technologies. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||