Educating 100 million people every year, we are the world's leading publisher of textbooks and electronic learning tools for students of all ages from pre-school to college and on into their professional lives. We are the world's leading company in testing students and professionals and in software that helps teachers teach and schools to manage information about student performance. We provide all these products both in the US and around the world, where we are also the world's leading publisher of English language teaching materials. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

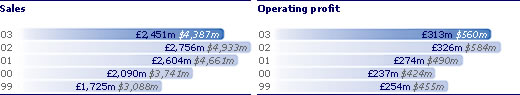

Sales at Pearson Education were 6% lower than in 2002, as good growth in our School and Higher Education businesses could not fill the gap left by the absence of the £250m TSA contract. Profits were 2% lower, as progress in School and Higher Education largely offset a 51% decline in our Professional operations. Margins improved as we benefited from sales growth, operating efficiencies and the 2002 disposal of FT Knowledge. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Jovanovich, Chief executive, Pearson Education |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In our School business, sales were 1% higher and operating profits up 13%. In the US, our textbook publishing business grew 2% as our basal imprints, Pearson Scott Foresman and Pearson Prentice Hall, increased revenues by 4% against basal market growth of some 1%. Our new elementary social studies programme took a market share of more than 50% in adoption states, helping Pearson to take the leading position in new adoptions with a share of approximately 29%. Sales at our supplemental publishing business were lower than in 2002 as we discontinued some unprofitable product lines and were affected by industry-wide weakness in state budgets. Although the same pressures reduced sales at our School digital learning business, strong cost management enabled it to return to a small profit. In School testing 2003 revenues were a little ahead of the previous year and we won more than $300m worth of new multi-year contracts which will boost sales from 2005, when the Federal Government's No Child Left Behind accountability measures become mandatory. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outside the US, revenues were up 7% with good growth in English Language Teaching and in our School publishing operations in Hong Kong, South Africa, the UK and the Middle East. Our UK testing business, London Qualifications, contributed revenues of £89m. Our Higher Education business increased revenues by 6% and operating profits by 11%. In the US the Higher Education publishing business grew its revenues by 6%. Excluding Pearson, the market grew by 3%. This comes on top of 14% revenue growth in 2002 and marks our fifth straight year of market share gains. Though industry growth slowed a little in 2003, the long-term fundamentals of growing enrolments, a boom in community colleges and a strong demand for post-secondary qualifications more than offset the impact of state budget weaknesses and rising tuition fees. Our business benefited from a strong schedule of first editions including Faigley's Penguin Handbook in English Composition, Wood & Wood's Mastering World Psychology and Jones & Wood's Created Equal in American History. The use of technology continues to distinguish our learning programmes, with almost one million students now following their courses through our paid-for online sites, an increase of 30% on last year, and a further 1.4 million using our free online services. Our market-leading custom publishing business, which creates personalised textbooks and online packages for individual professors and faculties, grew revenues by 35%, with sales exceeding $100m for the first time. Outside the US, our Higher Education imprints grew 7%, helped by strong growth in key markets including Europe and Canada, solid local publishing and the introduction of our custom publishing model. Revenues and profits were significantly lower in our Professional business, caused by both the absence of the TSA contract and the associated close-out costs. The $151m receivable from the TSA remains outstanding and we are discussing with the TSA the post-contract audit and payment. We expect this process to be completed in 2004, and that we will receive payment of the amount due, although the timing of the receipt remains uncertain. TSA apart, our Government Solutions business grew by 39%, benefiting from new contracts with the Department of Health and the USAC. The Professional Testing business won more than $600m of new long-term contracts. These include testing learner drivers for the UK's Driving Standards Agency, business school applicants for the Graduate Management Admissions Test and securities professionals for the National Association of Securities Dealers. Our worldwide technology publishing operations maintained margins despite a 12% drop in revenues. After a severe three-year technology recession, in which our publishing revenues have fallen by 36%, the rate of decline now appears to be slowing, particularly in the US. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||